Step #1: Start With Your Comp Set

It is always best practice to project your ADR & OCC that is derived from a Comp Set. The Comp Set (at least 4 other hotels) will allow you to get an idea of what similar hotels are achieving so that you have a realistic basis for your projections. This is beneficial for your underwriting not only because it allows you to see if the project makes financial sense but also provides credibility when you pitch to investors/lenders. Furthermore, in bigger deals with Hotel Management Agreements, the Comp Set will need to be agreed upon with the management company for some of the clauses in the HMA. In other words, the Comp Set will need to be solid. Please see my blog post on How To Develop A Comp Set.

Step #2: Gathering The Historical Comp Set Data And Projecting

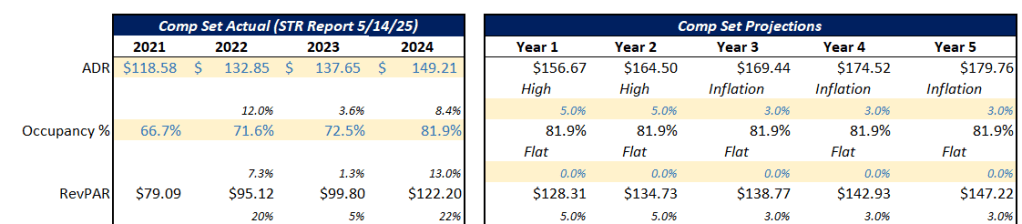

Once you have the Comp Set established, then it is time to get the historical data for these properties. If you saw my recent LinkedIn post, you will know that the source I have been using for this is an STR Trends Report. However, this has been phased out. In its place, is a subscription to the Costar platform, which provides the same data. Feel free to contact me about working with this platform.

Once you have the data, you want to create a table ,as shown in the image above, to show the historical ADR/OCC data for the Comp Set for at least 3 years. And then based on that, make some informed projections about the future years for at least 5 years. What are these? One option is to create 3 scenarios such as: Low, Mid, High. In the end, this is normally a discussion I have with clients on what these scenarios should be based on the market dynamics.

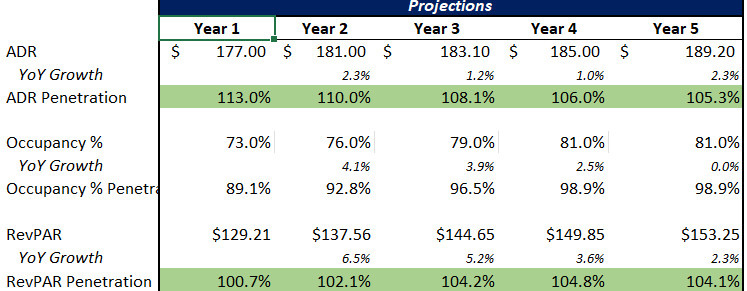

Step #3: Comparing Your Project’s Projections vs. Comp Set

Once you have the projections, then you bring in the projected ADR & OCC of your project that you have in the model to create an image as shown above in the header. This allows you to easily compare and show to investors/lenders how your projections stack up against the competition. In hotel underwriting, this metric of comparison is knows as Penetration Analysis. You will see there is ADR Penetration, Occupancy Penetration and RevPAR Penetration. All expressed as a percentages. If the percentage is above 100%, then what you are intrinsically stating is that you believe your project will outperform the competition for that metric in that given year. If it is below 100%, then you are stating that your project is projected to perform below the market for that metric in that particular year.

So What Results Should You Show?

Well it depends. This is where hotel underwriting strategy comes into play. There is no overriding hard and fast rule to what these numbers should be. This is where I sit down with clients and strategize how we want these numbers to look based on the project, the investor audience, the market, the lender, etc. While I build models that allow my clients (hotel developers, GP’s, Owners, Brands, etc.) easily insert inputs to see the financial results. The model is just a tool. What these inputs are, what is the strategy, who is the audience, what are parallel objectives are where the deeper discussions happen to ensure that my clients have credibility when going to market with their projects.

Leave a reply to How To Develop A Comp Set For Your Revenue Projections – MCD Hotel Advisors Cancel reply