A question that sometimes comes up from clients is why is my Levered IRR is lower than my Unlevered IRR? It seems like a great question right? After all, the point of adding debt is to drive up your Levered IRR and overall returns of the project. Well depending on the project, this may not hold. Let’s talk about the concept of Negative Leverage.

What Is Negative Leverage?

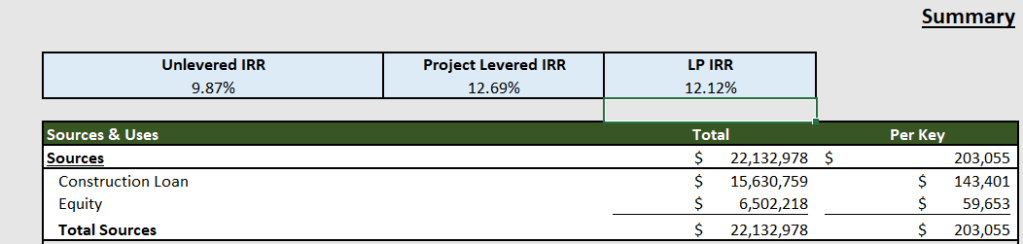

Let’s say we build out a hotel’s pro forma and financial model resulting in an Unlevered IRR = 10%. Now you go to your bank and they tell you that their terms include a interest rate of 11%. This is a situation called Negative Leverage or where your borrowing rate is higher than the rate of return of the investment as 11% is obviously greater than 10%. If this is the case, then the cost of the debt eats into the profits causing your Levered IRR to be lower than your Unlevered IRR.

When Leverage Enhances Project Returns?

Based on the above, it becomes pretty obvious that the project will benefit from the opposite scenario or when the Unlevered IRR % is greater than the loan interest rate. In the above example, if your banks instead says that they can lend at 8%, then your Levered IRR will be higher than your Unlevered IRR as the benefit of the decreased equity investment outweighs the cost of financing.

Potential Caveats

Many clients require complex model structures with tax credits, sales tax bonds, condo sales, rental pools, etc. that sometimes can throw this relationship off a little or more. Anytime we find some key relationships like these are not holding, we dig deeper to see what is causing the abnormal results. However, it is good to know this basic relationship to ensure your model is working as it should.

Leave a comment